President Trump’s top economic advisor, Kevin Hassett—director of the National Economic Council—says he is “very comfortable” that a trade deal with China will be sealed during high‑level talks in London on Monday, June 9, 2025. These crucial negotiations build on a 90‑day tariff truce agreed upon in Geneva in May, prompting optimism across global markets. The meeting in London, hosted by the U.K. for logistics support, brings together key U.S. figures—including Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer—facing off against China’s Vice Premier He Lifeng. Discussions aim to solidify and expand upon the Geneva framework, which temporarily reduced tariffs—U.S. duties dropped to 30 percent, China’s to 10 percent—but left lingering disputes over export controls, critical minerals, and technology-related restrictions.

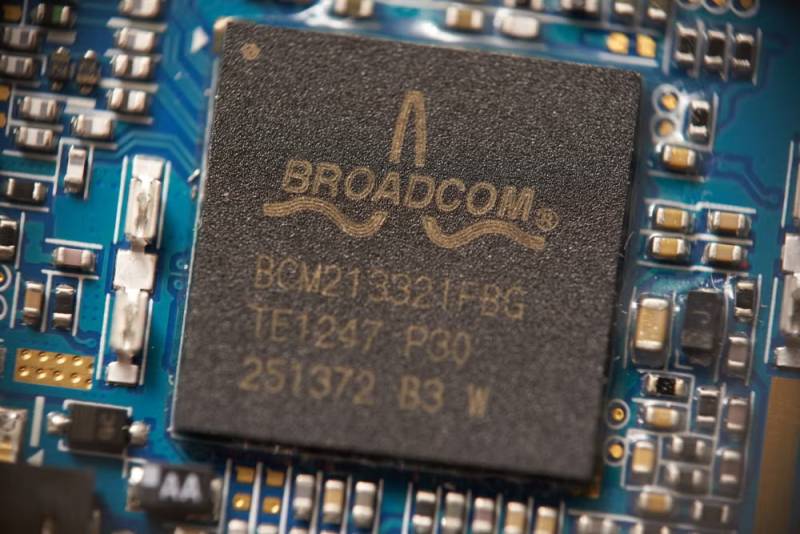

Stepping onto the stage as a stabilizing force, Hassett told CBS over the weekend, “I’m very comfortable that this deal is about to be closed,” hinting at final agreement details yet to be disclosed. His framework suggests increased access to Chinese rare‑earth minerals—vital to U.S. industries like defense, aerospace, and automotive—while potentially securing relief from America’s export-control regime that currently hampers advanced semiconductors and jet‑engine technologies. Markets have rallied in anticipation: Asian indices climbed, U.S. futures steadied, and global investor sentiment improved following both Trump–Xi phone engagement and preliminary Geneva results. North America’s equities pared past losses; the S&P 500, once plummeting 18 percent in April under tariff uncertainty, is now hovering just 2 percent below record highs.

Read Also: All of Downtown LA Declared an Unlawful Assembly Area

However, a new era of export-control diplomacy presents fresh complexity. The U.S. delegation—reinforced by Lutnick's regulatory oversight—now places specific focus on mechanisms governing sensitive tech exports, including semiconductors and rare‑earth elements. Meanwhile, China has begun easing export licenses for critical minerals, signaling goodwill while still demanding American easing of its technological restrictions. Despite guarded confidence, both sides continue to navigate broader friction points: U.S. concerns over Taiwan, technology transfer, and fentanyl trafficking; China’s insistence on equitable economic terms and national security protections. Additionally, jurists highlight legal challenges to Trump's tariff authority under the International Emergency Economic Powers Act (IEEPA), adding another layer to negotiations.

U.K. officials, though not part of substantive talks, praised the diplomatic venue: “We are a nation that champions free trade and have always been clear that a trade war is in nobody’s interests, so we welcome these talks,” reinforcing London’s role as host. On the eve of these talks, Hassett’s bullish tone infuses hope. A confirmed deal could thaw cooling trade tension, restore supply‑chain stability, and potentially renew investor faith. But with a ticking clock under the 90‑day Geneva pause—due to expire in mid‑August—what happens in London could determine whether this diplomatic thaw transitions into a durable commercial accord.

Uphorial.