Focusing on the relentless demand for Artificial Intelligence (AI), Bloomberg Technology anchors its coverage with co-hosts Ed Ludlow in San Francisco and Caroline Hyde in New York, dissecting the latest earnings from tech behemoths. The central theme emerging from Alphabet, Microsoft, and Meta results is the heavy spending on A.I. and data center construction.

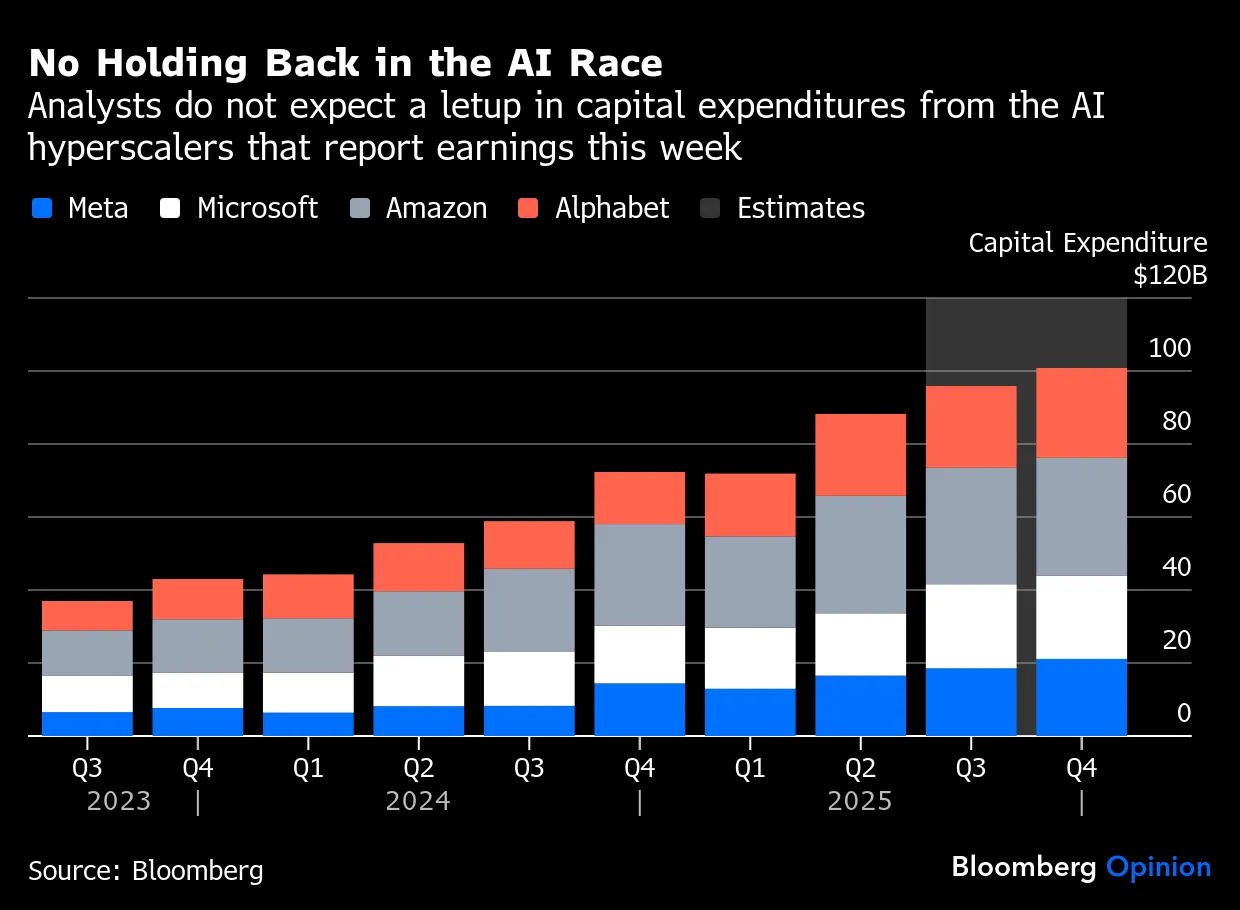

Caroline Hyde highlighted that the strong focus on infrastructure investment has led to a bifurcated market. Alphabet, the parent company of Google, was rewarded by the market, with its stock rising 5%. Ed Ludlow noted that Alphabet provided investors with two key data points: capital expenditures projected between $91 billion to $93 billion, and crucially, evidence of returns, as revenue from products built on Google’s generative AI models grew by more than 200% from a year earlier. This demonstrates that AI is "working" and that Google is successfully managing the "high wire act" of transitioning from search to AI. Analysts suggested that Google has "better A.I. underneath the hood than they are articulating".

In sharp contrast, Meta was the biggest decliner. Ludlow noted that its stock sold off sharply, falling 12%. The core issue was investor concern over capital expenditure guidance: Meta warned that Cap Ex would be "notably larger" in fiscal year 2026 than in 2025. Hyde questioned why there was "such an air pocket on the stage" when "everyone knew Cap X would go up to the right". The market was "spooked" because Meta failed to provide specific top-line or bottom-line growth figures directly tied to the AI investments, unlike Alphabet. CEO Mark Zuckerberg, however, expressed concern about the risk of "under investing".

Related article - Uphorial Sweatshirt

Microsoft, despite delivering strong cloud results—39% top-line growth in Azure, which exceeded consensus expectations—saw its stock decline by 3%. Caroline Hyde pointed out the interesting dilemma: Microsoft’s issue is "supply does not demand". Ludlow emphasized that the company's backlog is massive, and they "can’t literally physically provision it fast enough". This capacity constraint means the reported Azure number is not "way higher". Ludlow argued that the market's reaction to Microsoft was "wrong," given the massive backlog growth and 111% commercial bookings.

Beyond the Magnificent Seven, Bloomberg Technology addressed other market movements. Ed Ludlow reported on the meeting between President Trump and China’s Xi Jinping, noting that NVIDIA’s latest Blackwell processor was not discussed. This dampened speculation about Washington approving the sale of such high-end chips to China, a move welcomed by "defense hawks" over national security concerns. Caroline Hyde also welcomed the CEO of Roblox to discuss the gaming platform's numbers, noting that while users are expanding, so are costs. Roblox's daily active users topped 151 million, and bookings reached $2 billion in the third quarter. However, this growth comes at a cost, driven by infrastructure, safety, and cloud compute expenses.

Ultimately, the heavy investment by six or seven large companies, spending $350 billion this year on AI infrastructure, is viewed as necessary to keep up with demand that is doubling every nine to 18 months. Investors are moving toward infrastructure plays like energy and land while chasing momentum in a "narrow" market. The cautionary note from the Federal Reserve that they are unsure about cutting interest rates by 25 basis points also "dimmed the view" just as earnings came in.