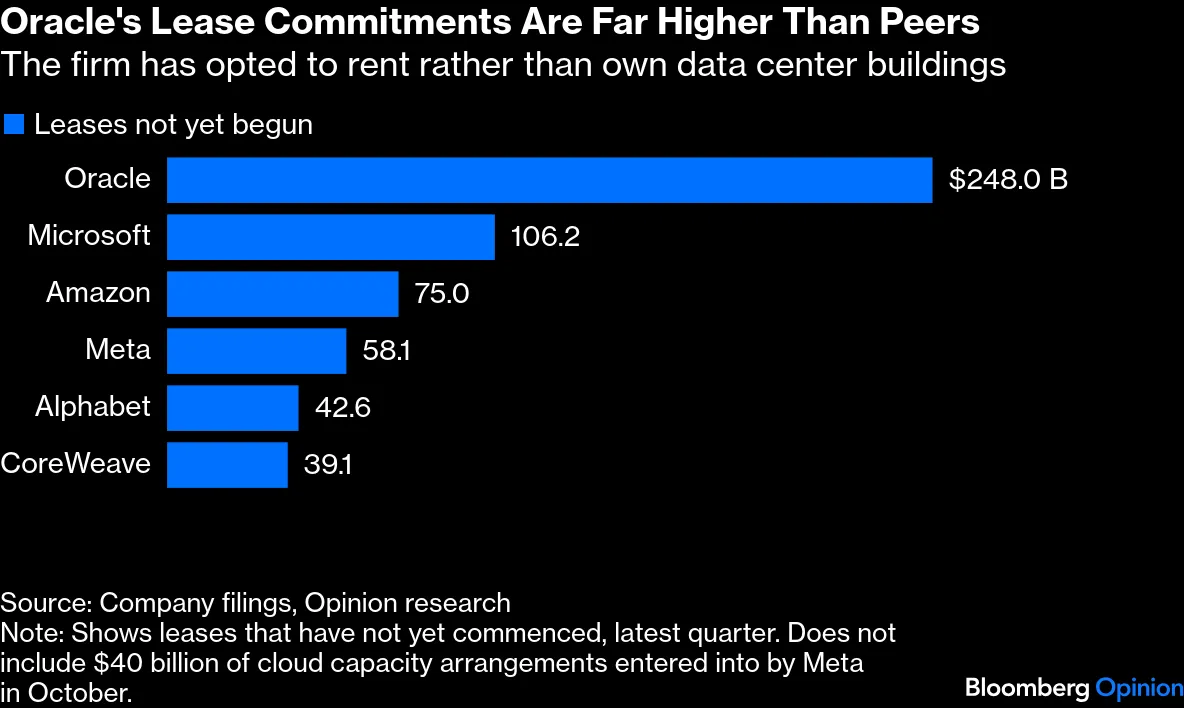

Investors are currently wrestling with the logistical and fiscal realities of the Artificial Intelligence "space race," a tension vividly illustrated on Bloomberg Technology as anchors Caroline Hyde and Ed Ludlow tracked a significant downturn for Oracle. Shares of the tech giant suffered their worst losses since December, triggered by news that its largest data center finance partner, Blue Owl Capital, will not back a $10 billion facility in Michigan. While Oracle maintains that the project remains on schedule with a different partner, the fallout has sparked intense questioning regarding the sheer scale of the company's off-balance-sheet commitments. Oracle is reportedly "on the hook" for between $250 billion and $300 billion in future-dated leases over the next two decades, a massive pivot for what was once primarily a software firm. Analysts noted that while established hyperscalers like Microsoft can manage such commitments, Oracle’s ambitious transformation requires a "once in a generation" execution where every logistical detail must go exactly as planned to satisfy a market growing wary of the total cost of buildouts.

Amidst these infrastructure anxieties, the conversation on Bloomberg Technology turned to the "circular deals" currently defining the industry. Caroline Hyde and Ed Ludlow detailed initial discussions for OpenAI to raise $10 billion from Amazon, an arrangement where OpenAI would buy $30 billion in compute capacity over seven years and Amazon would return a portion of that as equity. This strategic alliance is viewed as a significant endorsement of Amazon’s in-house AI chips, providing a necessary, less expensive alternative to NVIDIA's dominant hardware. Despite the creative financing involved, portfolio managers suggested that the market is not a "winner-take-all" scenario. Instead, they envision a "space race" heading to "multiple moons," where players like Alphabet, NVIDIA, AMD, and Broadcom all find specific domains of expertise within the expanding AI ecosystem.

The drive for capital is equally aggressive in the autonomous vehicle sector, where Alphabet’s Waymo is in talks to raise over $15 billion at a valuation exceeding $100 billion. Unlike many generative AI startups, Waymo is distinguished by having a "tangible product" already operating on the streets of San Francisco, though it remains a capital-intensive business requiring external support to scale into rural and international markets. This hunger for scale is mirrored by fintech startups like Imprint, which recently hit a $1.2 billion valuation by using AI to grow its business by 300% while only increasing its headcount by 20%. Even veteran tech leaders are looking toward radical new frontiers; Caroline Hyde reported that former Google CEO Eric Schmidt has taken the helm of Relativity Space with a potential plan to put data centers directly into orbit to circumvent earthly supply chain constraints.

However, this rapid expansion faces headwinds beyond just financing. On Bloomberg Technology, reporters noted that Tesla is facing a 30-day ban on car sales in California after regulators determined its advertisements were misleading. Simultaneously, a "bidding battle" for Warner Bros. Discovery has reached a crossroads, with the board urging shareholders to reject a $30-per-share offer from Paramount and David Ellison. The rejection is fueled by concerns that the bid lacks a personal backstop for the $40 billion in required equity, relying instead on a "risky" revocable trust. As the industry moves from the infrastructure phase toward the "application layer," the focus for investors is shifting toward domain-specific models and the "proof in the pudding" of actual productivity gains. For now, the market remains a sea of red as it weighs the promise of infinite demand against the reality of mounting debt and the ever-present question of an AI bubble.