New York - Bloomberg Technology navigated a complex landscape of shifting media alliances, massive capital expenditures in artificial intelligence, and a pivot in the electric vehicle market, painting a picture of an industry grappling with both immense growth and investor anxiety.

The media landscape took center stage early in the program as reports surfaced that Warner Bros. Discovery has reopened acquisition negotiations with Paramount/Skydance. This renewed interest follows a "sweetened" offer and a notable strategic move from Netflix, which issued a seven-day waiver to allow the talks to proceed. Despite the waiver, analysts noted Netflix’s underlying resistance to a potential Paramount deal, citing regulatory hurdles and concerns over the long-term health of the Hollywood ecosystem.

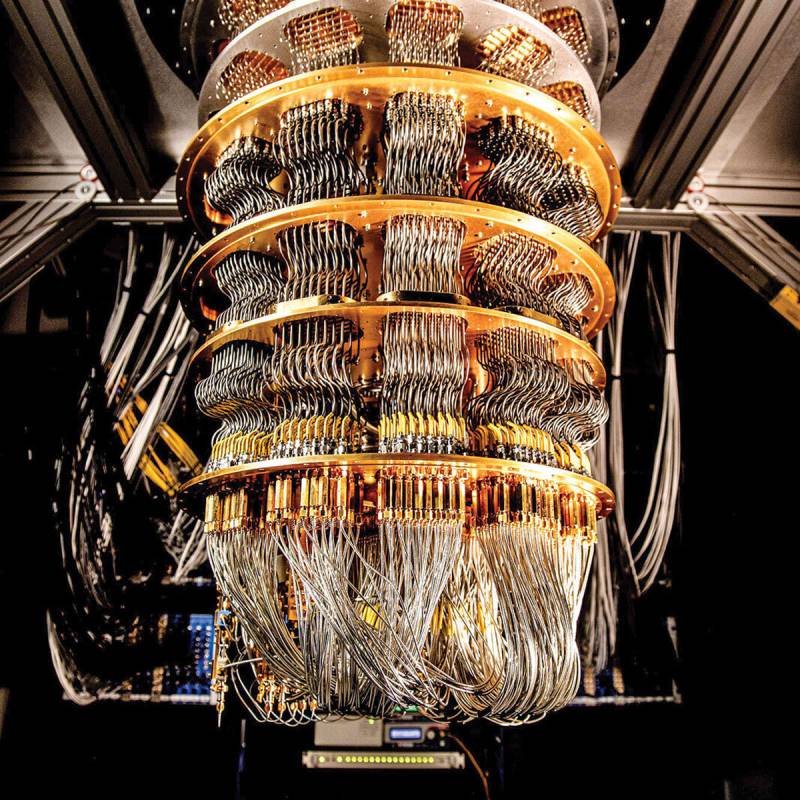

Simultaneously, the broader tech market is facing a wave of "AI jitters." While the four largest U.S. tech firms are projected to spend a staggering $650 billion combined this year on infrastructure, investors are beginning to question the timeline for a return on that investment. The debate intensified over whether the industry is witnessing a generational transformation or the inflation of a bubble. This skepticism is compounded by the "memory problem" currently bottlenecking compute demand and the difficult transition for traditional SaaS companies attempting to shift toward agentic, consumption-based AI models.

In the automotive sector, Ford is signaling a strategic retreat from high-priced luxury EVs in favor of affordability. The company revealed a re-engineered platform designed to deliver high-range electric vehicles starting at $30,000. This roadmap includes a new pickup truck slated for 2027 and the introduction of Level 3 semi-autonomous driving features by 2028.

Hardware enthusiasts also have their eyes on March 4th, as Apple prepares for a rare simultaneous in-person launch event in New York, Shanghai, and London. The synchronized global nature of the event has fueled speculation that a significant product—potentially a new low-cost MacBook—is imminent.

Looking toward the next decade, a new Barclays report projected that the "Physical AI" market—spanning humanoid robots, drones, and autonomous systems—could reach $1 trillion by 2035. Currently, China holds a commanding lead in this space, having deployed the vast majority of the world’s humanoid robots throughout 2025.

The financial markets showed signs of strain elsewhere, particularly in the crypto sector. Bitcoin has recorded four consecutive weeks of losses, struggling under the weight of geopolitical tensions and shifting expectations regarding Federal Reserve rate cuts. Despite this volatility, some institutional players remain bullish on big tech; Soros Fund Management notably doubled its stake in Microsoft, signaling confidence in the software giant’s long-term AI positioning.

The program concluded with a focus on the next generation of infrastructure and talent. Mesh Optical Technologies, a startup founded by SpaceX alumni, secured $50 million from Thrive Capital to onshore the manufacturing of optical transceivers for GPU clusters, a move aimed at securing a supply chain currently dominated by overseas entities. Meanwhile, digital talent management firm Knights raised $70 million, betting on a future where the world’s biggest stars in music and sports emerge not from traditional scouts, but from the algorithms of YouTube and TikTok.