The global technology landscape is undergoing a period of intense volatility and rapid transformation, characterized by regulatory confusion, massive capital shifts in artificial intelligence, and a high-stakes earnings season. From the Pentagon’s sudden policy reversals to the emergence of an "AI scare trade" on Wall Street, the latest developments highlight a sector in the midst of a significant structural realignment.

The day’s most striking geopolitical development occurred when the U.S. Defense Department briefly added major Chinese tech giants, including Alibaba, Baidu, and BYD, to a list of companies allegedly linked to the Chinese military. The move triggered a sharp, temporary sell-off in U.S.-listed shares of these firms. However, in a move that left investors seeking clarity, the Pentagon quickly withdrew the designations without providing an official explanation, highlighting the ongoing tension and unpredictability of U.S.-China tech relations.

As regulatory uncertainty looms, the frenzy surrounding AI financing shows no signs of cooling. Anthropic has finalized a landmark $30 billion funding round, effectively doubling its valuation to a staggering $380 billion. This momentum is extending into the defense tech sector, where Shield AI is reportedly in discussions to raise $1 billion, a move that would also double its valuation to roughly $12 billion. This influx of capital coincides with what analysts are calling the "AI scare trade," where small startups making AI-related announcements are exerting outsized influence on the market. This phenomenon is causing notable volatility across diverse industries, from logistics to wealth management, as established players scramble to defend their market share against perceived AI disruption.

The infrastructure supporting this digital shift appears robust, as evidenced by Twilio’s latest financial performance. The company’s first-quarter revenue forecast exceeded analyst estimates, fueled by sustained demand for messaging and voice services. CEO Khozema Shipchandler emphasized Twilio’s role as a foundational layer for AI companies, noting that their usage-based pricing model allows the firm to scale directly alongside the growth of its clients' AI applications.

The broader earnings landscape provided a mix of optimism and resilience. Rivian saw its stock surge as investors pinned their hopes on the upcoming R2 mass-market electric vehicle, looking past current financial losses toward a high-volume future. Similarly, Airbnb and Instacart both issued positive outlooks; Airbnb continues to benefit from a resilient travel sector, while Instacart is gaining traction through new technological partnerships and retail solutions.

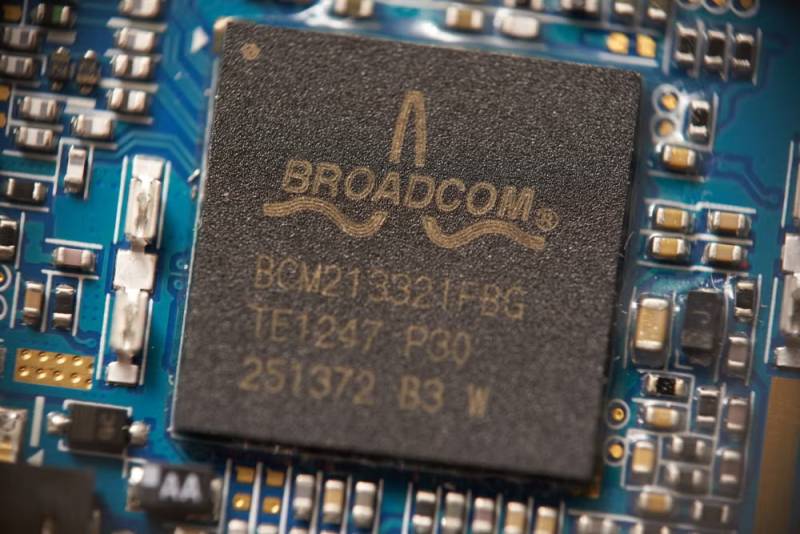

In the semiconductor and crypto sectors, the narrative was one of recovery and long-term positioning. Applied Materials reported stellar earnings, signaling that investment in data center infrastructure remains aggressive despite economic headwinds in the Chinese market. Conversely, Coinbase reported a 20% decline in fourth-quarter revenue as the crypto market cooled. However, its stock managed a rebound as investors bet on a market bottom and the potential for clearer regulatory frameworks in the near future.

The appetite for early-stage innovation remains high, as evidenced by Primary Venture Fund closing a new $625 million fund. This brings the firm’s total assets under management to $1.65 billion, with a specific focus on seed-level AI opportunities. This venture activity is occurring even as AI leaders begin to adopt aggressive political strategies. Taking a page from the cryptocurrency industry’s playbook, AI executives are increasingly backing congressional candidates who favor light-touch regulation to ensure domestic innovation is not stifled by premature legislative hurdles.

Finally, the tech industry continues to grapple with its social impact. While social media platforms face intense scrutiny and potential bans related to teen addiction lawsuits, the financial impact has been surprisingly muted. Industry growth and advertising revenue remain largely unaffected, as advertisers shift their focus toward older demographics, demonstrating the sector's ability to maintain profitability even in the face of significant legal and ethical challenges.