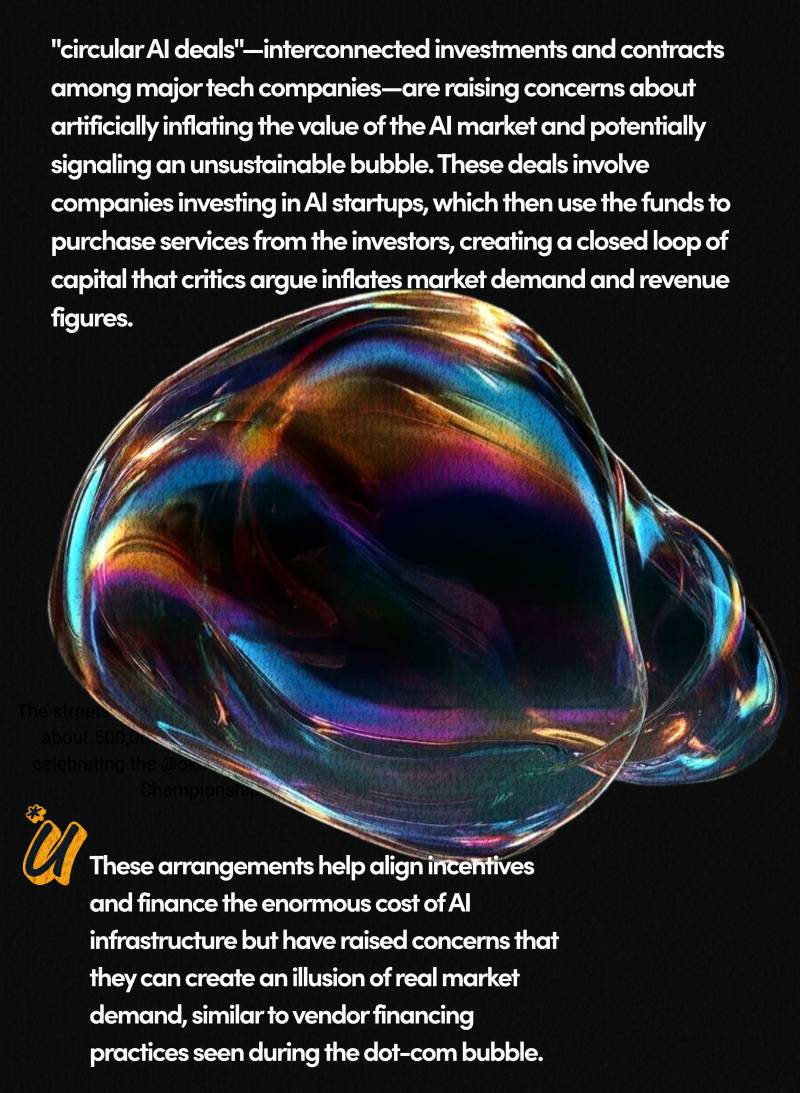

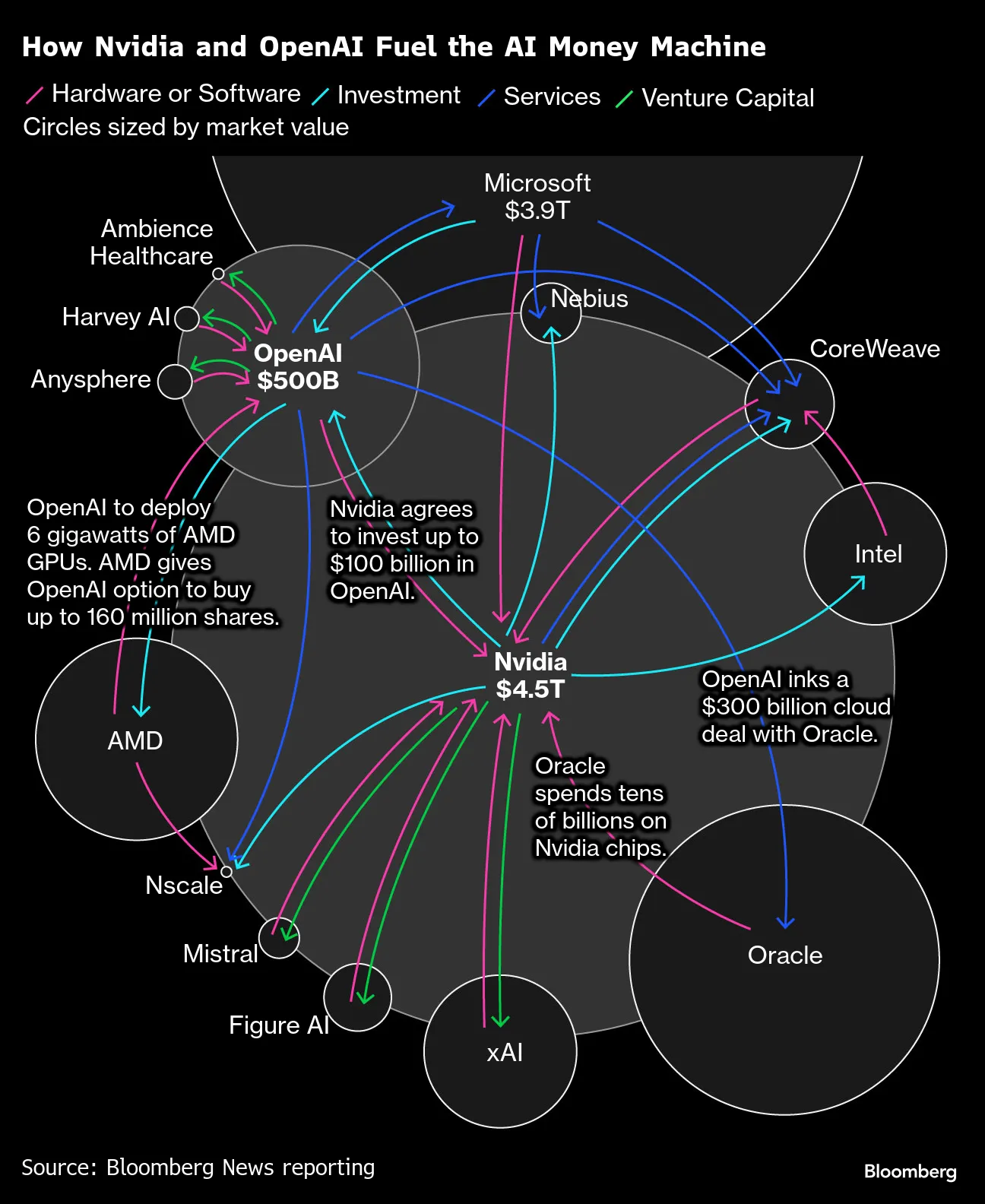

The global Artificial Intelligence industry is embroiled in a massive financial experiment characterized by multibillion-dollar "circular deals" that are actively fueling fears of a technology bubble, as covered extensively by Bloomberg Technology. This narrative centers on companies like NVIDIA, described as selling the "troubles in today's AI job rush".

NVIDIA is striking mega deals to invest in the very companies that purchase its products, creating a self-reinforcing cycle where capital flows into unproven companies, cycles into data centers, and then returns to NVIDIA as revenue from advanced chips. This cycle involves trillions being spent on technology that remains "somewhat unproven as a business model".

The nervousness surrounding this high-stakes spending continues. Despite critics pointing to the murky revenue-sharing agreements and the practice of suppliers funding customers while customers invest in suppliers, NVIDIA Chairman Jensen Huang affirmed that they, along with OpenAI, are "thoughtful in aligning on and taking into consideration visibility of demand and their financing capabilities," asserting that the execution is disciplined.

The core debate is whether the AI boom is sustainable. Some skeptics warn of a significant correction, with one expert suggesting that finding the revenue to justify the AI revolution is "impossible by 2030". Others remain confident, arguing that the bubble has merely gotten "ahead of itself, not the likelihood of growth in the future," insisting there is "substance under the foam". The Foxconn Chairman, whose company is the largest supplier of AI services to Oracle and involved directly with OpenAI, downplayed concerns about circular deals, stressing that the demands for AI capabilities are real across all businesses. He pointed out that if OpenAI’s 800 million subscribers can generate $100 per year from enough users, the financial goals are achievable, potentially generating about $80 billion annually.

Related article - Uphorial Sweatshirt

Asia's technology titans are critically exposed to this boom as they play a critical role in the global supply chain. TSMC, which manufactures chips for NVIDIA, AMD, and Qualcomm, is considered an impartial barometer for underlying demand and the safest bet in the sector. Additionally, Samsung Electronics and SK Hynix are seeing margins rise on High-Bandwidth Memory chips (HPMs), which NVIDIA's GPUs require to function. Bloomberg Economics forecasts demand for Korean chips surging by 35% next year, almost double the current rate.

The Japanese conglomerate SoftBank is often viewed as a "poster child for any bubble". SoftBank, a financier with a portfolio spanning OpenAI, Byte dance, and Perplexity AI, sold its entire $5.8 billion stake in NVIDIA to bankroll its founder's AI ambitions. This moves amplified market anxiety. SoftBank has promised to invest $30 billion into OpenAI by the end of the year, despite not having that much money. Critics fear these bold bets could backfire, drawing parallels between SoftBank's commitment to OpenAI and the "very similar business model" of WeWork, citing an asset-liability mismatch. The concern is heightened by competitors like Google, which has introduced what some view as a superior product with Gemini 3, while having the advantage of strong balance sheets and established businesses.

Asian markets show distinct dynamics compared to the U.S. While U.S. stock markets are penalizing companies making the transition to AI—like Oracle, whose stock gave up all gains after its deal with OpenAI—companies in Asia are considered "more protected from real earnings expectations". The CEO of Alibaba, which has embraced an open-source approach to Large Language Models, stated that he does not see an AI bubble forming within the next two to three years, believing supply will not meet demand. However, the high costs are evident: Oracle’s gross profit margin on AI infrastructure leasing is only 17%, compared to 70% for its core ERP business.

Ultimately, the AI investment scheme is seen as a pyramid. Experts agree that the ones at the top—suppliers and infrastructure providers like NVIDIA and TSMC—are better positioned to weather the storm. Conversely, the individual players on the bottom layer, the Large Language Model developers like OpenAI, which lack any other business, are positioned to suffer the most if the boom bursts. The fact that, unlike the internet bubble of the past where companies had different ambitions, everyone in the current AI market is trying to come out with the "same thing, General Artificial Intelligent Machine," makes this boom distinctly different.