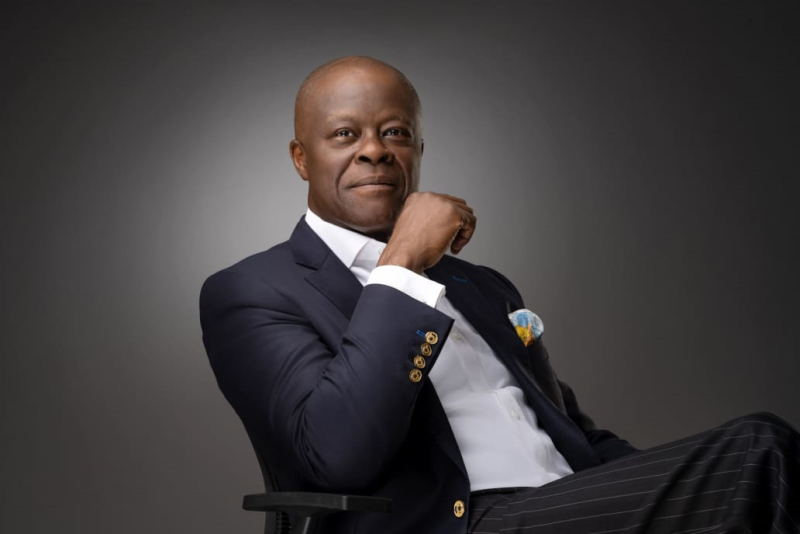

The United States is currently navigating a fiscal trajectory that many fear is leading toward historical insolvency. David Rubenstein, a private equity veteran who has spent three decades observing how leaders ascend to and remain at the top, sat down with Ray Dalio to dissect these mounting global concerns. Dalio, the founder of Bridgewater Associates, warned that when countries essentially go "broke," they inevitably turn to a combination of currency devaluation and money printing to manage their obligations. This process creates artificially low interest rates that punish bondholders by paying them back in "devalued dollars," a cycle Dalio believes is already occurring. During the discussion, Rubenstein pressed for immediate solutions, questioning why the Federal Reserve wouldn't simply cut interest rates further to save on the trillion dollars currently spent on interest for national debt. However, Dalio argued that forcing rates down would only destroy the demand for those bonds, potentially triggering a dangerous downward spiral.

Dalio views tariffs as a historical mainstay of government revenue that can help build necessary national self-sufficiency in an increasingly fractured world where the U.S. can no longer afford to depend heavily on imports. While not ideal for global economic efficiency, Dalio noted that such measures are pragmatic for a nation needing to stimulate domestic manufacturing. For the individual investor navigating this environment, Dalio shared his central "mantra" for success: a portfolio composed of 15 uncorrelated return streams, which he claims can reduce overall risk by up to 80% without sacrificing potential returns. Rubenstein noted that while many people seek out Dalio for specific investment tips at cocktail parties, his advice remains rooted in these technical principles. He recommends that prudent investors hold between 10 to 15 percent of their portfolio in gold, describing it as a unique store of wealth and the only asset that is "not somebody else's liability".

Related article - Uphorial Shopify

For risk-averse middle-class Americans, Dalio suggested that the safest vehicle is an inflation-indexed bond, such as Treasury Inflation-Protected Securities (TIPS), which guarantees a real return above inflation. He warned against general market speculation, which he characterized as a "zero-sum game" where most non-professionals are likely to lose. Much of this systematic approach—which Dalio documents as "principles"—was born from a devastating personal failure in the early 1980s that left him so financially ruined he had to borrow $4,000 from his father to pay his family's bills. This experience taught him to balance his natural audacity with the humility to constantly ask, "How do I know I'm right?".

As the interview concluded, the dialogue shifted from financial mechanics to the philosophy of a well-lived life. Dalio told Rubenstein that there is a very low correlation between happiness and extreme wealth once basic needs are met. Instead, he argued that the highest level of well-being is derived from a strong sense of community and the ability to make one's work and passion the same thing. While Dalio expressed a long-term hope that the U.S. can move through its current debt crisis by understanding the cause-and-effect relationships of history, Rubenstein offered a grounded perspective from his years in the capital. He noted that making progress in Washington is notoriously difficult, as the political environment often prioritizes infighting over the implementation of such rigorous fiscal principles.