In order to restore the economies of the continent after the COVID-19 epidemic, Chinelo Anohu, Senior Director at the African Development Bank (AfDB), has urged for stronger strategic alliances and increased participation from African sovereign wealth funds.

Anohu made the decision while delivering the keynote talk at the most recent third high-level gathering of African sovereign wealth funds organized by Brown Capital Management Forum.

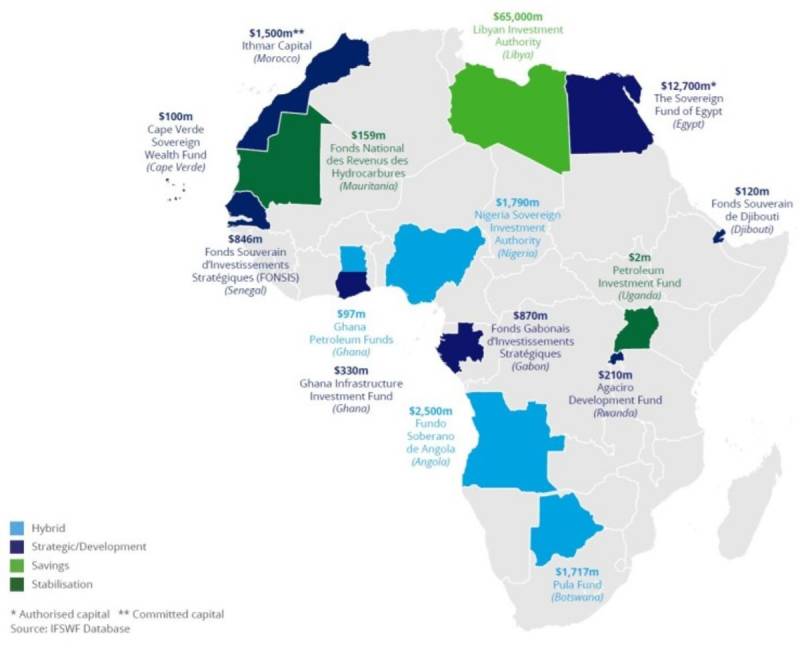

15 of the top 17 countries with the greatest sovereign wealth funds (SWFs) export a significant amount of oil and gas; however, Nigeria is the only nation with negligible savings. Despite rising oil prices, Nigeria can only claim to have $3 billion in the Nigeria Sovereign Investment Authority (NSIA).

Over $1.3 trillion in savings are held by Norway, which exports 1.2 million barrels of oil every day, in her Government Pension Fund Global, commonly known as the "Oil Fund." Each of Saudi Arabia and the UAE has approximately $1 trillion in savings. Kuwait has $738 billion in rainy-day reserves, Qatar $450 billion, Russia $191 billion, Kazakhstan $133 billion, Iran $91 billion, Libya $66 billion, Brunel $60 billion, and Azerbaijan $42 billion, according to the Global Sovereign Wealth Fund.

READ ALSO: Toronto Artist Yung Yemi Partners With Crown Royal To Redefine Royalty

The Africa Investment Forum is the continent's top marketplace for investments, helping to speed up deals that narrow investment gaps in Africa.

The two-day conference, themed Strengthening the Role of African Sovereign Wealth Funds in the International Financial System, was held at the Wilson Centre in Washington, DC. Since its inception in 2015, the Brown Capital Management Africa Forum has provided a forum for American and African corporate executives, decision-makers, and specialists to exchange ideas on furthering sustainable development and business ties.

Anohu claimed that in just two years, the Coronavirus outbreak had erased 20 years' worth of advancements. 40 million Africans, primarily women and children, have been forced into extreme poverty as a result of the pandemic's exposure of structural flaws in the continent's physical and social infrastructure, she claimed.

The pandemic's impacts have worsened as a result of Russia's war in Ukraine. Prices for food and fuel have increased as a result of the war. Anohu emphasized that at least $1.2 billion in annual expenditures in crucial infrastructure are necessary for Africa's recovery. Africa cannot afford to be left behind or caught in the thick of geopolitical rivalries, she said.

President of the Wilson Center Mark Green and Chairman of Brown Capital Management Eddie Brown also spoke at the occasion. The discussion, according to Dr. Monde Muyangwa, director of the Wilson Center's Africa Program, "could not be more timely."

Following her approval by the US Senate to serve as President Biden's Administrator for Africa at the United States Agency for International Development, Muyangwa's employment at the Wilson Center has come to an end. At the closing ceremony, she received recognition for her accomplishments at the Center.

“This really is a crucial moment for all of us to think about these challenges, but also how we pursue opportunities that will take us through these challenges,” said Mark Green. “How can sovereign wealth funds also adapt to these changing times, and what role can they play in stabilizing economies and creating that vibrant economic growth that is so key to the continent’s future?”

Eddie Brown said: “The world is changing at a rapid rate, and it is imperative that governments and financial systems adapt to it.” He said sovereign wealth funds should be an integral part of the conversation on navigating these challenges. “Early on its establishment, the Wilson Center African program recognized the critical role of sovereign wealth funds to transform Africa’s economic development, yet these institutions were not widely known.”

In her keynote address, Anohu noted that Africa’s sovereign wealth funds collectively invested about $12.7 billion in 2020—three times as much as in 2019— in response to the pandemic’s impacts. Still, she pointed out, they are seen as lacking the tools needed to identify and evaluate quality projects for investment.

“This is a gap that the Africa Investment Forum stands ready to fill,” Anohu emphasized, inviting meeting participants to attend the Africa Investment Forum’s 2022 Market Days this November. She explained that financing Africa’s ambitious development agenda demanded an enhanced role for African sovereign wealth funds.